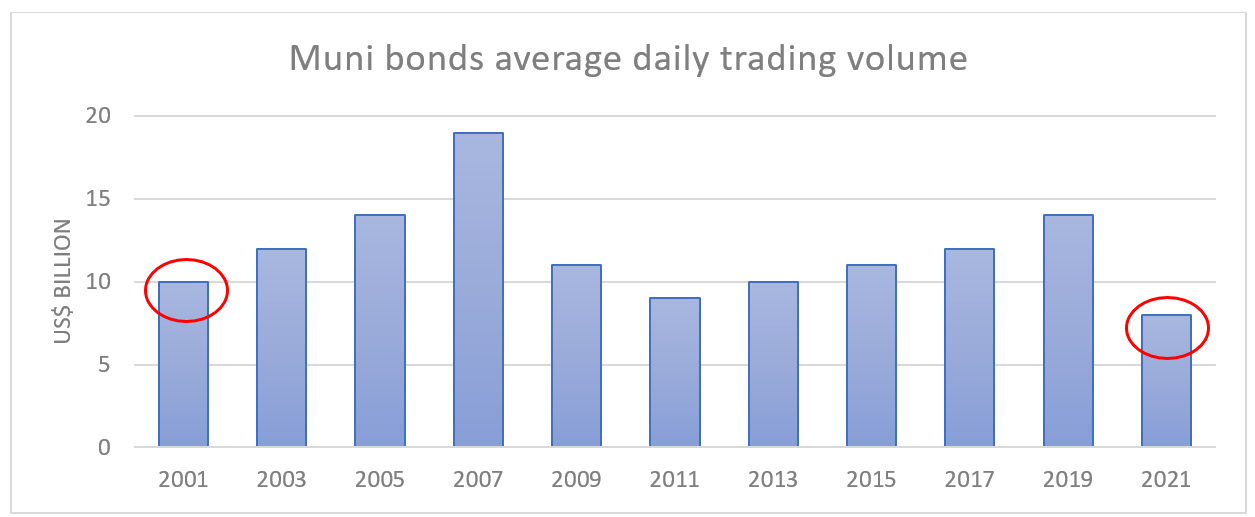

The lowest trading volume in two decades has been leading investors to acquire more and more new local and state Muni issuances, even at low spreads.

Executive Summary: If you are a municipal bond issuer, there is no better time to issue new bonds. The Muni bond market is red hot and ready to absorb new issuances, as demand outstrips ever-growing supply. We believe that demand is driven by: (i) talk of higher taxes, (ii) returned confidence in local and state issuers, and now (iii) summer redemption period where cash will be reinvested. The Fed has also helped build confidence with programs that increase liquidity for the Muni market. While issuances are up year-over-year (YOY), they have not been able to keep up with demand as the market remains cash-heavy. If that mismatch continues, investors may decide to diversify away from Munis, leading to higher spreads and a smaller overall market.

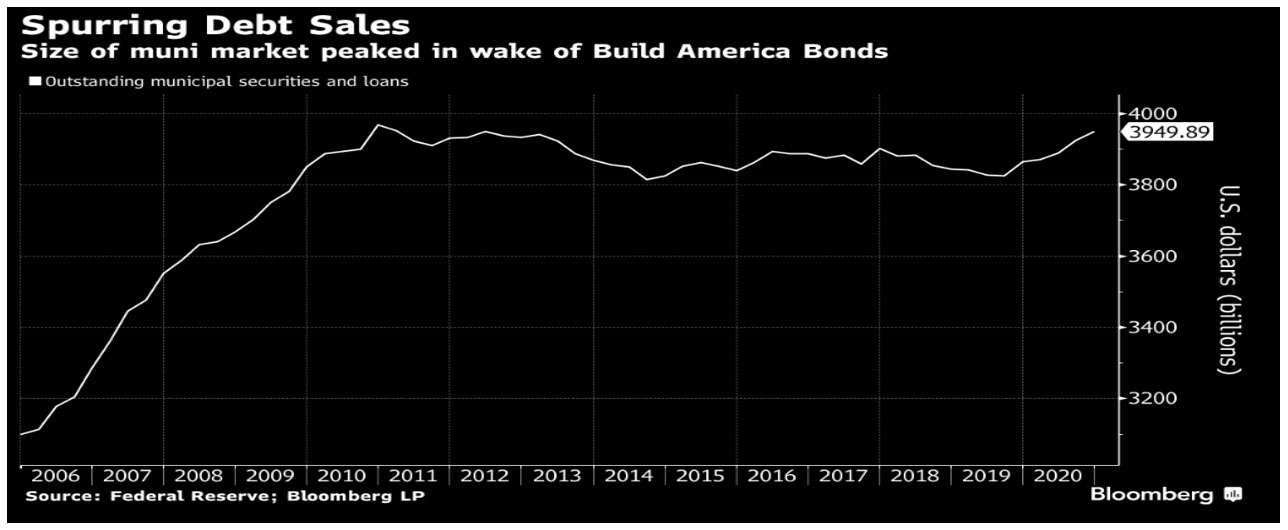

Muni bonds are a US$ 3.8 trillion 1 market – They are part of a very large (US$ 49.9 2 trillion) US fixed-income industry. With the threat of higher taxes, 3 flush investors want to acquire some exposure to high-quality tax-free fixed-income products with a tacit guarantee from the US government: Munis.

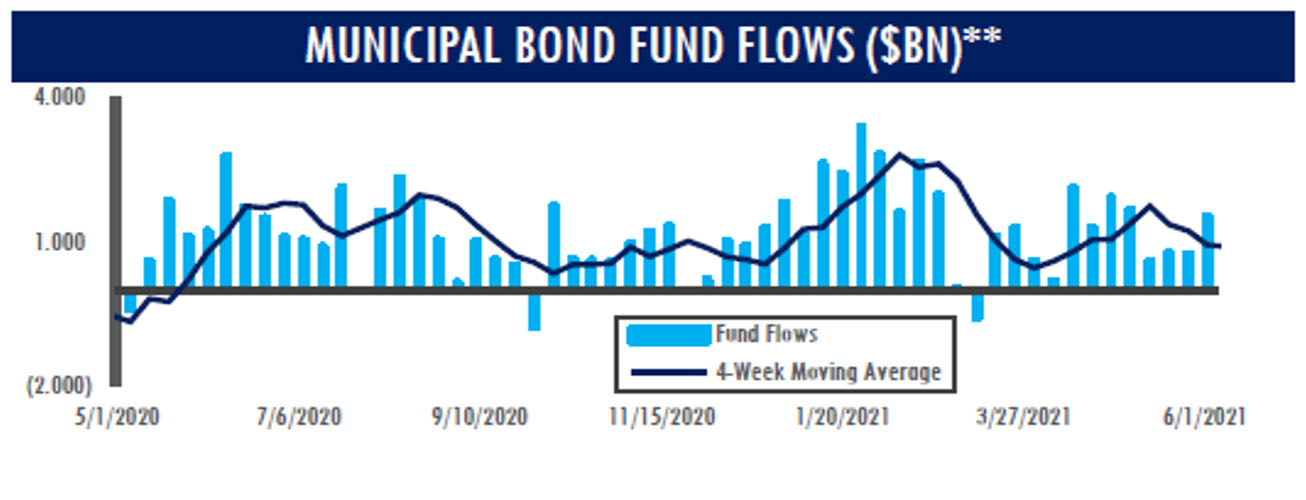

Investors hold onto their Munis and do not want to sell them – Although YOY Muni issuances are up, that has not been enough supply to keep up with demand. As analysts 4 continue to proclaim that Munis are a great investment (and that this is “a good year for Muni issuers”) investors 5 have poured US$ 1.9 billion per week on average into the Muni market this year. This is more than four times the past 10-year average. Demand has been so strong that even rising supply has not been able to satiate it.

As a result, many Muni-hunters are left empty handed. To make matters worse, the few investors who are lucky enough to have Munis in their portfolio are holding onto them and do not want to trade. According to Bloomberg news, 6 Muni trading volumes are now at a 16-year low. There have been 32,500 trades per day this year, the lowest average since 2005, with a US$9.3 billion volume, the lowest level since 2001.

Source: MSRB – Note: Data is an average of daily par amount traded between Jan 1 and June 8 for each year.

Munis yield great returns compared to other fixed-income products – There is really nowhere else to invest in fixed income. Munis are up 0.51% this year, 7 compared with overall bonds that are down 2.7%, 8 or investment grade bonds which are down 3.55%. 9 Yields on 10-year local bonds are at 60% of US Treasuries, the lowest since 2001. 10

Year-to-date Muni bonds issuances are at US$ 170 billion, US$ 16.5 billion above the historical average – However, demand is still high. Muni bond funds continue to see record- breaking cash flow into the market, with over US$ 40 billion this year. Demand for Munis by mutual funds and ETFs has risen in 51 of the past 53 weeks as credit sectors improve and a continued threat of changes in taxation loom over investors. 11

Source: Yahoo Finance

“Funds are buying any Munis, regardless of price discovery” – The market forecasts another US$ 116 billion in redemption and coupon payments in the coming months. This will create an even wider gap in supply vs. demand. Citigroup estimates that the amount of money that investors will receive in principal and interest payments this summer will surpass new issuances by US$ 62 billion. 12 Some analysts anticipate a “food fight,” 13 where buyers scramble to buy new high-yield Muni issuances, with large funds buying any product regardless of price discovery. It is a positive moment for those municipalities and states that are considering floating bonds.

The Stimulus Plan:

Transfers to local governments by sector – The federal government authorized US$ 350 billion in transfers to local governments on May 10th, 2021, as part of the US$ 1.9 trillion rescue plan. 14 They will send US$ 195 billion for states, territories, and tribal governments and US$ 130 billion for cities and counties, including US$ 10 billion for infrastructure projects. 15 In addition to the US$ 350 billion in state and local assistance, the bill provides US$ 130 billion for K-12 education, US$ 40 billion for higher education, US$ 50 billion for small businesses, US$ 7 billion for restaurants, and US$ 7 billion for broadband and other responsibilities at the local level. 16

Government is adding even more liquidity into these municipalities – So, what is Biden’s exact plan for local government transfers? According to the Wall Street Journal, 17 Biden’s plan will direct funds for social spending, water/sewage projects and broadband expansion, but not for tax cuts. ETF database analysts called Biden’s plan “even more tailwind for high-yield Munis.” 18

Some local governments actually do need the help – There are opposing views on what the package can do for the municipal market. Some claim that these funds may negatively affect much needed supply of Muni bonds at a time when the market is hot. Others see this as a way out for struggling state and local governments who can use the money to cover balance sheets deficits, and thus improve their credit ratings. While both sides might have a point, there are some local governments that are struggling, while others have excess liquidity.

What Lies Ahead?

Is this the return of tax-exempt advance refunding? – Eliminated by the Tax Cuts and Jobs Act of 2017, it was greatly affected by the overall tax-exempt issuance of Munis and helped increase the market of taxable bonds. The new Democrat-backed infrastructure legislation includes plans to restore it. It will allow issuers to refund tax-exempt debt outside of the 90-day window. As a result, this may put a dent in taxable Munis, but overall, it is expected to add US$ 100 billion in issuances for 2022.

Another federally subsidized debt program? – Local governments and Wall Street groups have also advanced the idea of federally subsidized debt. These bonds are similar to the old Build America Bonds (BABs) issued under the 2009 American Recovery and Reinvestment Tax Act. There were more than US$ 180 billions BABs issued, which helped municipal bonds to peak at the time.

*Source Bloomberg

BABs rules were changed in the past – Federal bonds would still be taxable to investors, as were BABs, but the government would cover part of the interest costs. The subsidized taxable debt could allow local issuers to market their bonds to overseas investors, pension funds, taxable buyers, and others that do not often buy traditional tax-exempt paper. Yet some issuers still hurt from past losses due to government spending cuts, which ended up shrinking the yearly subsidies on BABs issued in 2009.

What lies ahead for the municipal bond market? – Municipal bond demand and supply may remain mismatched for a while now, as it moves into the seasonal redemption period and as stimulus money continues to be disbursed, keeping rates low in the process. It is an issuer’s market, as this unmet demand for municipal bonds should mean even thinner spreads in the future. However, investment firms might decide to rearrange their fixed-income portfolios due to the lack of available Muni supply. In a time of rising demand and excess liquidity, Munis might fall out of favor, and thus might have to pay higher spreads eventually, if investors become unaccustomed to acquire them.

Bernardo Weaver is a senior finance consultant at the World Bank Group in Washington DC and a finance professor to top investment banks and Hedge Funds in Wall Street. Mr. Weaver also teaches M&A as an adjunct professor at Georgetown McDonough School of Business and at Pepperdine University Graziadio School of Business. Mr. Weaver is a Wharton MBA grad, and holds an LLM from UConn Law, and a law degree from P.U.C.- Rio, in Brazil.

Bernardo Weaver is a senior finance consultant at the World Bank Group in Washington DC and a finance professor to top investment banks and Hedge Funds in Wall Street. Mr. Weaver also teaches M&A as an adjunct professor at Georgetown McDonough School of Business and at Pepperdine University Graziadio School of Business. Mr. Weaver is a Wharton MBA grad, and holds an LLM from UConn Law, and a law degree from P.U.C.- Rio, in Brazil. Ms. Livingston has over 14 years of professional experience in municipal bond underwriting, financial advisory, and the brokerage industry. She is the Lead Underwriter and Manager of Municipal Banking at Blaylock Van, LLC and based out of the California Headquarters in Oakland, CA. Ms. Livingston graduated from California State University Long Beach with a Bachelor of Arts and holds her FINRA Series 7, 63, 50 and 53.

Ms. Livingston has over 14 years of professional experience in municipal bond underwriting, financial advisory, and the brokerage industry. She is the Lead Underwriter and Manager of Municipal Banking at Blaylock Van, LLC and based out of the California Headquarters in Oakland, CA. Ms. Livingston graduated from California State University Long Beach with a Bachelor of Arts and holds her FINRA Series 7, 63, 50 and 53.**Disclaimer**

This article was prepared exclusively for Blaylock Van, LLC. Links are solely intended for convenience and are not intended to be advertisement whatsoever. Linked sites are not under the control of Blaylock Van, LLC and Blaylock Van, LLC is not responsible for the content of any linked site or any link contained in this article. Blaylock Van, LLC does not endorse companies, or their products or services, to which it links. If you decide to access any of the third-party sites linked to this site or article, you do this entirely at your own risk. This document is confidential and has been prepared for informational purposes only. This document is not to be construed as a recommendation, an offer to sell or a solicitation of an offer to buy any securities. Any dissemination, distribution or reproduction of this document is strictly prohibited without the consent of Blaylock Van, LLC. The information herein is obtained from sources deemed reliable, but its accuracy and completeness cannot be guaranteed, and is subject to change without notice.

[1] Ilya Perlovsky, & Tom DeMarco. (2018). Overview of the Taxable Municipal Market. fidelity.com. https://www.fidelity.com/bin-public/060_www_fidelity_com/documents/fixed-income/retail-taxable-muni-white-paper-2018.pdf

[2] US Fixed Income Securities Statistics. Securities Industry and Financial Markets Association. (n.d.). https://www.sifma.org/resources/research/us-fixed-income-securities-statistics/.

[3] Lydon, T. (2021, May 27). As Tax Talks Ramp Up, Investors Turn to Municipal Bonds. ETFdb.com. https://etfdb.com/retirement-income-channel/tax-talks-ramp-up-investors-turn-to-municipal-bonds/.

[4]Napach, B. (2021, May 18). 3 Reasons Why Muni Bonds Are Still a Good Buy. ThinkAdvisor. https://www.thinkadvisor.com/2021/05/18/3-reasons-why-muni-bonds-are-still-a-good-buy/.

[5] The Investment Company Institute

[6] Bloomberg. (n.d.). Muni bond hunters left empty handed with-trading at 16 year low. Bloomberg.com. https://www.bloomberg.com/news/articles/2021-06-10/muni-bond-hunters-left-empty-handed-with-trading-at-16-year-low.

[7] Bloomberg Barclays Municipal Bond Index

[8] Bloomberg Barclays Aggregate Bond Index

[9] Bloomberg Barclays Investment Grade Bond Index

[11] Lydon, T. (2021, May 27). As Tax Talks Ramp Up, Investors Turn to Municipal Bonds. ETFdb.com. https://etfdb.com/retirement-income-channel/tax-talks-ramp-up-investors-turn-to-municipal-bonds/.

[13] Riquier, A. (2021, June 10). ‘Food fight’ in the municipal-bond market as demand devours all supply. MarketWatch. https://www.marketwatch.com/story/food-fight-in-the-municipal-bond-market-as-demand-devours-all-supply-11623353532.

[14] Napach, B. (2021, May 18). 3 Reasons Why Muni Bonds Are Still a Good Buy. ThinkAdvisor. https://www.thinkadvisor.com/2021/05/18/3-reasons-why-muni-bonds-are-still-a-good-buy/.

[15] Ibid.

[16] Ibid.

[17] Rubin, R. (2021, May 10). Biden Administration to Start Doling Out $350 Billion in Aid to State, Local Governments. The Wall Street Journal. https://www.wsj.com/articles/biden-administration-to-start-doling-out-350-billion-in-aid-to-state-local-governments-11620666000.

[18] https://etfdb.com/retirement-income-channel/tax-talks-ramp-up-investors-turn-to-municipal-bonds/