Why you should look into issuing investment grade paper before the Fed changes its mind…

Executive Summary: The window to issue new corporate bonds at historically low yields might be closing soon. The Fed just announced its intent to taper the exchange-traded funds (ETF) and bond purchase program. While it is early to estimate when the Fed will actually decide to raise rates, bond-buying tapering is enough to reassure us yields will rise. Blaylock Van is well-positioned as one of the few traditionally minority-owned banks to have joined in some of the most significant investment grade corporate bond issuances of the past year.

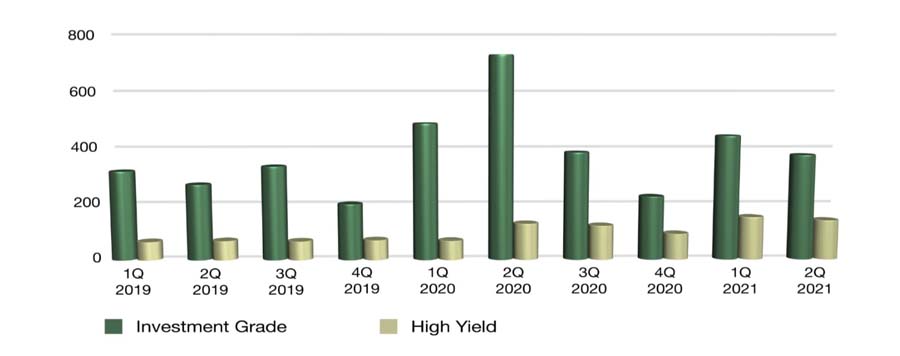

Total corporate bonds issuance reached US$ 873 Billion in the second quarter of 2021. 1 As it is pointed out on the chart below, bond issuances have fluctuated tremendously in the past eight quarters. Although the economy in 2019 was at full speed, investment-grade bond issuances (in dark green) were declining. When the pandemic hit in late Q1 2020, the government bond- buying package (SMCCF – Secondary Market Corporate Credit Facility) came to rescue bond issuers. As a result, issuance volume went up. Consequently, this helped investment-grade issuances hit a US$ 741.1 Billion peak. High-yield bonds, as one can see — in gold — in the figure below, remained somewhat stable during this period. In 2021, with the Fed tapering rumors and the risk of higher bond spreads, there has been a rush towards new issuances well above 2019 levels.

Figure 1- Number of Corporate Bond Issuances (2019-2021)

Graph elaborated by the author with data from SIFMA 2

The Fed has amassed a portfolio of approximately US$ 14.2 Billion in assets through the SMCCF. 3 In the beginning of the COVID-19 lockdown, there was broad concern over companies’ performance. The Fed started buying corporate bonds individually and through ETFs to keep firms above water. However, as recently as June 2021, the Fed announced the intent to sell these bonds. The key reason for this policy change is the rosy economic situation with 6.6% y-o- y Q2 GDP growth 4 and a 5.2% august 2021 unemployment rate. 5 The Fed wants to taper this program smoothly, to avoid any unintended consequences. So, there is still time to float bonds.

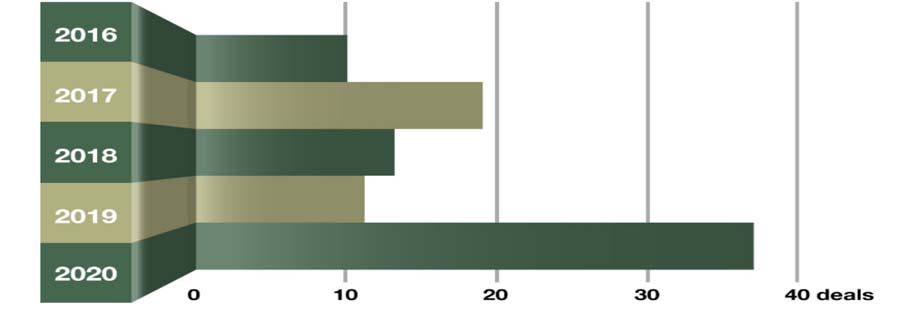

Investment grade bonds issuances are on the rise. In 2020, Blaylock Van participated in the issuance of US$ 164 billion of debt 6 . Alphabet Inc., Apple, Citibank, IBM, Ford, and Wells Fargo are some of the investment-grade companies advised by Blaylock Van. With over 30 years of experience in financial markets, these remarkable results can be traced back as positive externalities of diversity and equality in finance. The business case for diversity is well-known: better, smarter decision-making due to the broader demographic perspectives involved. 7 In the figure below, you can see corporate bond issuance by minority firms in the past 5 years. The rise in 2020 is clear:

Figure 2- Number of corporate bond issuances advised by minority firms

Source: Figure art by the author with Bloomberg data 8

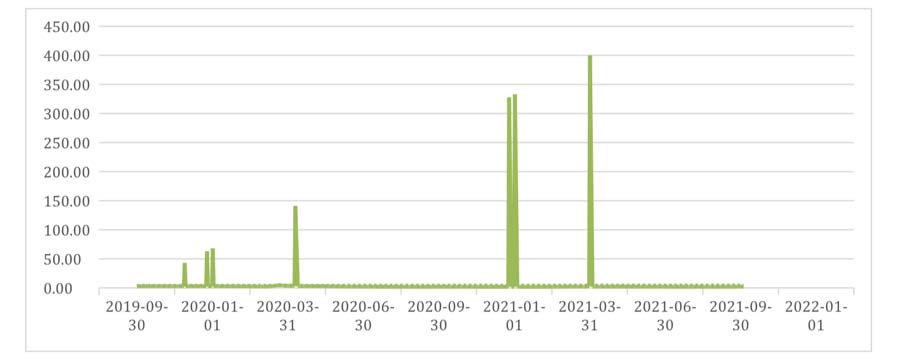

Investment grade corporate bonds have been issuing at around 2% for almost two years now 9 . After last year’s peak early March of 2020, when bonds were issuing at almost 5%, there was a dramatic decline in rates to as low as just under 2%. The Fed’s efforts regarding monetary policy were enough to control the pandemic’s effects. The stability for the following months can be easily explained: firms managed to perform better than first expected at the beginning of the lockdown due to the federal stimulus. As one can see on the figure below, the reduction from March to June was dramatic. And, since then, rates did not vary too much.

Figure 3 – Corporate Bond Index Trend (2019-2021)

Ice Data Indices, LLC, ICE BofA US Corporate Index Effective Yield [BAMLC0A0CMEY], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/BAMLC0A0CMEY, October 6, 2021.

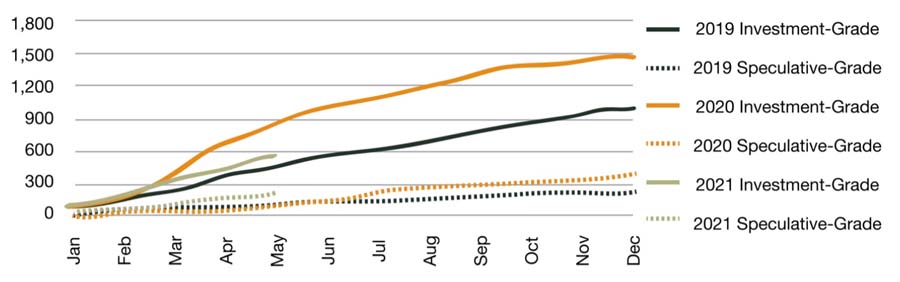

As one can see on the figure above, even though there has been a slight increase as of the last few months, financing conditions are still above par. Now, with the Fed’s most recent announcement regarding the end of the SCMMF, the market will face a slight rise in yields, which might raise borrowing costs. Still, the current scenario is much more advantageous than previous years. Inflation may lead to real negative yields. The federal stimulus package may have helped drive CPI to 5.3% y-o-y. 10 For issuers, high inflation means “real” yields will go down. At an estimated inflation rate of 2.5% over the next 5 years, investment-grade bonds are issuing at effectively negative yields. As one can see in the figure below, this boosted issuances even more:

Inflation may lead to real negative yields. The federal stimulus package may have helped drive CPI to 5.3% y-o-y. 10 For issuers, high inflation means “real” yields will go down. At an estimated inflation rate of 2.5% over the next 5 years, investment-grade bonds are issuing at effectively negative yields. As one can see in the figure below, this boosted issuances even more:

Graph elaborated by author with data from S&P Global Ratings 11

Bernardo Weaver is the CEO of Weaver Advisory, producing Macro Research, Financial Modeling, and transaction advice to global financial institutions. Mr. Weaver has over 17 years of experience advising the World Bank on international deals. He is a financial modeling instructor to top investment banks and hedge funds in Wall Street and London. He also teaches M&A as an adjunct professor at Georgetown University’s McDonough School of Business. Mr. Weaver holds a Wharton MBA degree and has been based in Washington D.C. for the past 20 years, living in Georgetown with his wife and two kids.

Bernardo Weaver is the CEO of Weaver Advisory, producing Macro Research, Financial Modeling, and transaction advice to global financial institutions. Mr. Weaver has over 17 years of experience advising the World Bank on international deals. He is a financial modeling instructor to top investment banks and hedge funds in Wall Street and London. He also teaches M&A as an adjunct professor at Georgetown University’s McDonough School of Business. Mr. Weaver holds a Wharton MBA degree and has been based in Washington D.C. for the past 20 years, living in Georgetown with his wife and two kids.**Disclaimer**

This article was prepared exclusively for Blaylock Van, LLC. Links are solely intended for convenience and are not intended to be advertisement whatsoever. Linked sites are not under the control of Blaylock Van, LLC and Blaylock Van, LLC is not responsible for the content of any linked site or any link contained in this article. Blaylock Van, LLC does not endorse companies, or their products or services, to which it links. If you decide to access any of the third-party sites linked to this site or article, you do this entirely at your own risk. This document is confidential and has been prepared for informational purposes only. This document is not to be construed as a recommendation, an offer to sell or a solicitation of an offer to buy any securities. Any dissemination, distribution or reproduction of this document is strictly prohibited without the consent of Blaylock Van, LLC. The information herein is obtained from sources deemed reliable, but its accuracy and completeness cannot be guaranteed, and is subject to change without notice.

Bibliography

[1] US Corporate Bonds Statistics. Securities Industry and Financial Markets Association. (n.d.). Retrieved August 10, 2021, from https://www.sifma.org/resources/research/us-corporate-bonds-statistics/

[2] https://www.sifma.org/resources/research/us-corporate-bonds-statistics/

[3] FAQs: Secondary Market Corporate Credit Facility. FAQs: Secondary Market Corporate Credit Facility – FEDERAL RESERVE BANK of NEW YORK. (n.d.). Retrieved September 17, 2021, from https://www.newyorkfed.org/markets/primary-and-secondary-market-faq/corporate-credit-facility-faq/

[4] Gross Domestic Product, 2nd Quarter 2021 (Second Estimate); Corporate Profits, 2nd Quarter 2021 (Preliminary Estimate). BEA. (n.d.). Retrieved September 30, 2021, from https://www.bea.gov/news/2021/gross-domestic-product-2nd-quarter-2021-second-estimate-corporate-profits-2nd-quarter/

[5] U.S. Bureau of Labor Statistics. (2021, September 9). Unemployment rate drops to 5.2 percent in AUGUST 2021.

U.S. Bureau of Labor Statistics. Retrieved September 30, 2021, from

https://www.bls.gov/opub/ted/2021/unemployment-rate-drops-to-5-2-percent-in-august-2021.htm

[6] Debt Capital Market Overview 2020. Debt Capital Markets – Blaylock Van, LLC. (n.d.). Retrieved September 17, 2021, from https://brv-llc.com/investment-banking/debt-capital-markets/

[7] Up Against Wall Street Bond Giants, Minority Firms Want More. (2021, January 1). Retrieved August 6, 2021, from

https://brv-llc.com/weathmgmt/wp-content/uploads/2021/01/Bloomberg_Magazine2.pdf

[8] https://brv-llc.com/weathmgmt/wpcontent/uploads/2021/01/Bloomberg_Magazine2.pdf

[9] Ice Data Indices, LLC, ICE BofA US Corporate Index Effective Yield [BAMLC0A0CMEY], retrieved from FRED,

Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/BAMLC0A0CMEY, October 6, 2021.