The investment banking team at Blaylock Van has more than 100 years of combined bulge-bracket experience, putting us at the forefront of banking and capital markets arena and making us a leader among black-owned asset management firms. We have managed over hundreds of debt and equity banking transactions representing billions of dollars in underwriting. Blaylock Van was the first minority firm to co-manage a debt deal for a company in 1995.

Home > Investment Banking

Our client base covers U.S. and European clients, covering a range from asset managers, insurance companies and pension funds to municipalities and family offices, and we value every single partnership we make. We truly appreciate our clients’ continued support of diversity and inclusion in their capital markets activities.

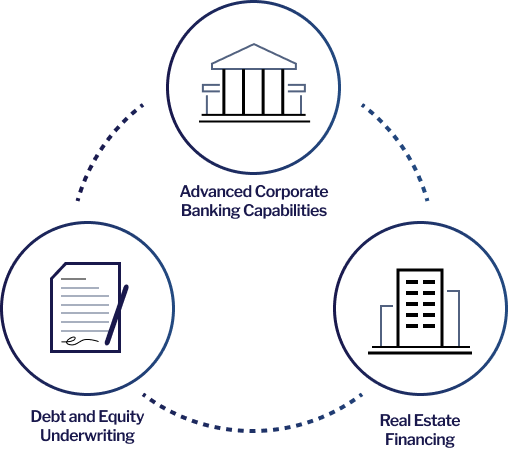

We are well-positioned to help aspiring investment banking firms, managers, and funds, as well as encourage the continued success of already-established financial entities.

We seek to foster long-standing partnerships with clients as we help them achieve success using a thorough and tech-led approach to investing.

In 2023, Blaylock Van participated in 64 transactions totaling $169 billion in notional volume.

Transactions

We are proud to serve as a Joint Bookrunner in a recent $600m New York Life offering on January 22, 2024. In 2023, we also served as a Co-Manager on three of the four largest debt deals year-to-date, including Amgen’s $24bn 8-part and HSBC Holdings PLC’s $7bn 3-part transaction in March, 2023 (the largest FIG deal of the year).

Metropolitan Transportation Authority

New York Cty Transitional Finance Authority

Massachusetts Housing Finance Agency

3.864% 8NC7

6.350% 30NC10

5.333% 11NC10

The City of New York

The City of New York

Blaylock Van, LLC, 600 Lexington Ave, 3rd Floor New York, NY 10022, (212) 715-6600

Oakland Office

350 Frank H. Ogawa Plaza, 10th Floor Oakland, California 94612, (510) 208-6100

© 2023 Blaylock Van, All Rights Reserved.